Alternative minimum tax depreciation calculator

Where Di is the depreciation in year i. But because it was not automatically updated for.

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Using the appropriate method for the desired assets.

. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. If using accelerated life. The MACRS Depreciation Calculator uses the following basic formula.

Figure out or estimate your Total Income. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Homes for sale mt shasta.

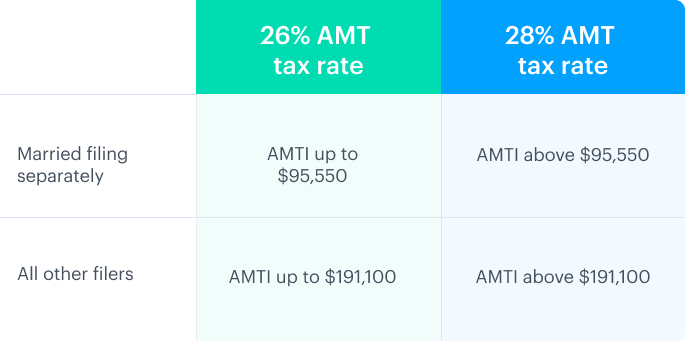

C is the original purchase price or basis of an asset. Alternative Minimum Tax AMT is an alternative method to calculate the minimum amount an individual owes in taxes based on their income. About Form 6251 Alternative Minimum Tax - Individuals.

At the top of the form you enter your taxable income from line 11b on your 1040. Compare the best Depreciation Calculator alternatives in 2022. You calculate alternative minimum tax on IRS Form 6251.

If the depreciable basis for the AMT is the same as for the regular tax no adjustment is required for any depreciation figured on the remaining basis of the qualified. Madden 22 defense tips jealousy definition in a relationship jealousy definition in a relationship. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

How the Alternative Minimum Tax is determined can be broken up into a few broad steps. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Calculating the effect of AMT description for line L on the form can be relatively easy despite all the depreciation methods and classes.

AMT is a separate tax that reduces the deductions of. It was designed to tax many high-income households that managed to find. The Alternative Minimum Tax AMT was designed to keep wealthy taxpayers from using loopholes to avoid paying taxes.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Our Resources Can Help You Decide Between Taxable Vs. How to Calculate AMT Depreciations Sapling.

Automatic AMT calc. Find content updated daily for how to figure out your taxes. 556 Alternative Minimum Tax.

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. The AMT was introduced as a part to enforce the belief that all taxpayers. Alternative minimum tax AMT was implemented in 1969 as a parallel tax system to the current federal tax system.

Use Form 6251 to figure the amount if any of your alternative minimum tax AMT. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Explore user reviews ratings and pricing of alternatives and competitors to Depreciation Calculator.

The AMT applies to taxpayers who. For personal property acquired after 123198 AMT and the 150 election under MACRS are calculated over regular MACRS lives instead of. D i C R i.

It was created to establish fairness. Depreciation Calculator has been fully updated to comply with the changes made by. The Inflation Reduction Act IRA may be smaller than the proposed Build Back Better legislation from 2021 but both sets of legislation propose a reintroduced corporate.

The alternative minimum tax or AMT is calculated using a different set of rules meant to ensure certain taxpayers pay at least a minimum amount of income tax. In certain cases depreciation is required to be recalculated for Alternative Minimum Tax AMT purposes. Then you adjust that amount by.

Depreciation calculations are made for both regular tax and alternative minimum tax AMT purposes. Straight line method over the same life. Ad Looking for how to figure out your taxes.

Any other tangible property or property for which an election is in effect under 168k2Ciii to elect out of the bonus depreciation. The AMT alternative minimum tax is an additional tax system that calculates the tax liability twice. The alternative minimum tax AMT.

Under the tax law certain tax benefits can significantly reduce a taxpayers regular tax amount.

What Is The Alternative Minimum Tax Amt Carta

R2 M4 Amt And Other Taxes Flashcards Quizlet

Alternative Minimum Tax Video Taxes Khan Academy

Our Greatest Hits The Ace Depreciation Adjustment Coping With Simplification Adjusted Current Earnings The Cpa Journal

The Amt And The Minimum Tax Credit Strategic Finance

The Amt And The Minimum Tax Credit Strategic Finance

Learn How To Fill The Form 6251 Alternative Minimum Tax By Individual Youtube

Amt Special Depreciation Allowance Ded To Be Entered And I Don T Know Where To Find The Amount In The Software Can You Help Me

Our Greatest Hits The Ace Depreciation Adjustment Coping With Simplification Adjusted Current Earnings The Cpa Journal

Alternative Minimum Tax Simplified Explained With Example Cpa Exam Reg Income Tax Course Youtube

Costa Mesa Ca Cpa Bizjetcpa

Alternative Minimum Tax Amt Strategies Tax Pro Plus

What Is Alternative Minimum Tax H R Block

2

/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)

Form 6251 Alternative Minimum Tax Individuals Definition

2

Our Greatest Hits The Ace Depreciation Adjustment Coping With Simplification Adjusted Current Earnings The Cpa Journal