29+ Income tax payment calculator

That means that your net pay will be 40568 per year or 3381 per month. If you know your tax code you can enter it or else.

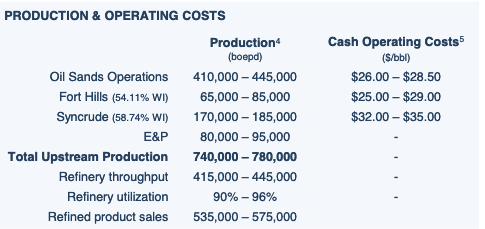

Suncor Energy A Safer Way To Play The Oil And Gas Rebound Nyse Su Seeking Alpha

Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable income.

. The calculator will calculate tax on your taxable income only. If you make 55000 a year living in the region of New York USA you will be taxed 11959. 1 minutes On this page Helps you work out.

Your average tax rate is. ० मअकर 0 VAT करपट Tax Plate New Tax Codes Applicable from 2075-04-01 Withholding Tax TDS Advance Tax FY 2076-77 Fines and Penalties under Income Tax Act. Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas.

On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. How much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are removed your. This means that after tax you will take home 2573 every month or 594 per week.

It can be used for the 201314 to 202122 income years. To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay.

That means that your net pay will be 37957 per year or 3163 per month. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The tax calculator provides a full step by step breakdown and analysis of each.

Your average tax rate is. How to use our Tax Calculator To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and. Income Filing Status State More options After-Tax Income 57688 After-Tax Income.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. If your salary is 40000 then after tax and national insurance you will be left with 30879. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document.

Between 50271 and 150000 youll pay at 40 known as the higher rate and above. Youll note that in our discussion of tax rates above that we used the term taxable income This is different from actual income earned because it accounts for tax deductions. That means that your net pay will be 43041 per year or 3587 per month.

Using The Tax Calculator To start using The Tax Calculator simply enter your annual salary in the Salary field in the left-hand table above. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Fixed Term Fixed Payments Loan Amount Loan Term years Interest Rate APR Monthly.

Your average tax rate is. Income between 50271 and 150000 - 40 income tax Income above 150001 - 45 income tax Note that your personal allowance will reduce by 1 for every 2 you earn over 100000. To find net payment of salary after taxes and deductions use the Take-Home-Pay Calculator.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Effective tax rate 172. Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Your household income location filing status and number of personal.

Suncor Energy A Safer Way To Play The Oil And Gas Rebound Nyse Su Seeking Alpha

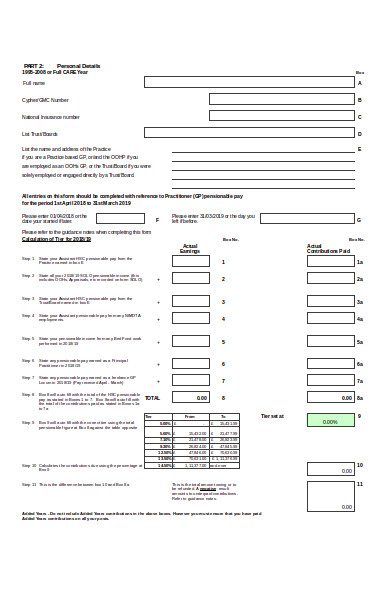

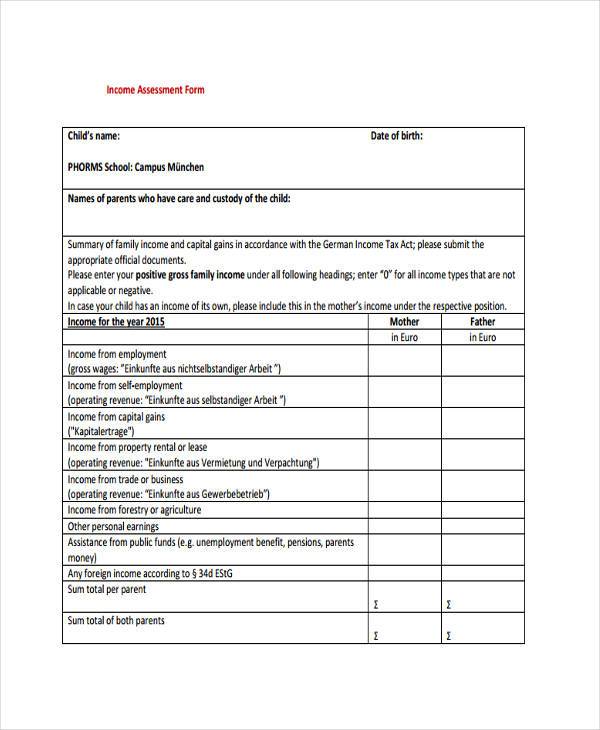

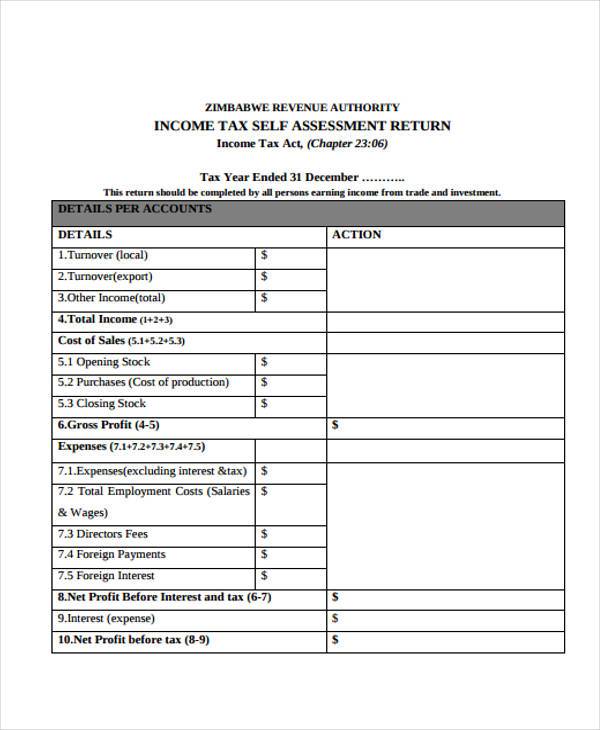

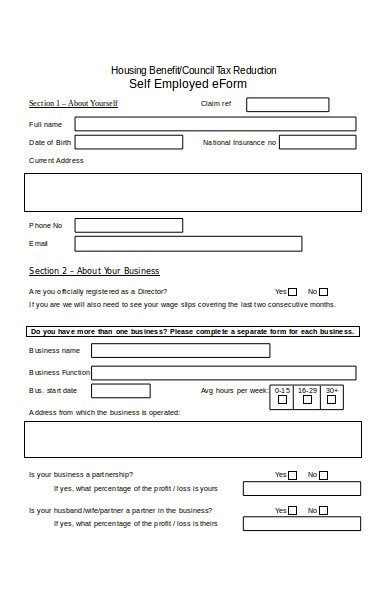

Free 11 Assessment Forms For Income In Pdf Ms Word Excel

Income Statement Template Excel Income Statement Statement Template Excel Spreadsheets Templates

Donation Calculator Spreadsheet Inspirational Goodwill Values Tax Golagoon Donation Tax Deduction Tax Deductions Spreadsheet Template

Cost Of Sales Templates 8 Free Ms Docs Xlsx Pdf Excel Templates Sales Template Excel

Growth Chart Calculator Baby Growth Chart Baby Weight Chart Baby Growth

Free 11 Assessment Forms For Income In Pdf Ms Word Excel

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Business Template

Drs

Free 11 Assessment Forms For Income In Pdf Ms Word Excel

Income Statement Templates 29 Free Docs Xlsx Pdf Income Statement Statement Template Profit And Loss Statement

Premium Photo 1040 Us Individual Income Tax Form With Glasses Accounting Concept Tax Time

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Free 11 Assessment Forms For Income In Pdf Ms Word Excel

Introduce Yourself The College Solution

Slimemoldtimemold Slime Mold Time Mold

Best 10 Apps For Calculating Auto Financing Last Updated August 29 2022